LTC Price Prediction: Bullish Momentum Building Toward $130 Target

#LTC

- LTC trading above 20-day MA indicates short-term bullish momentum

- MACD convergence suggests potential trend reversal from bearish to bullish

- Strong fundamental catalysts including Fed rate cuts and expanding ETF adoption

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerging

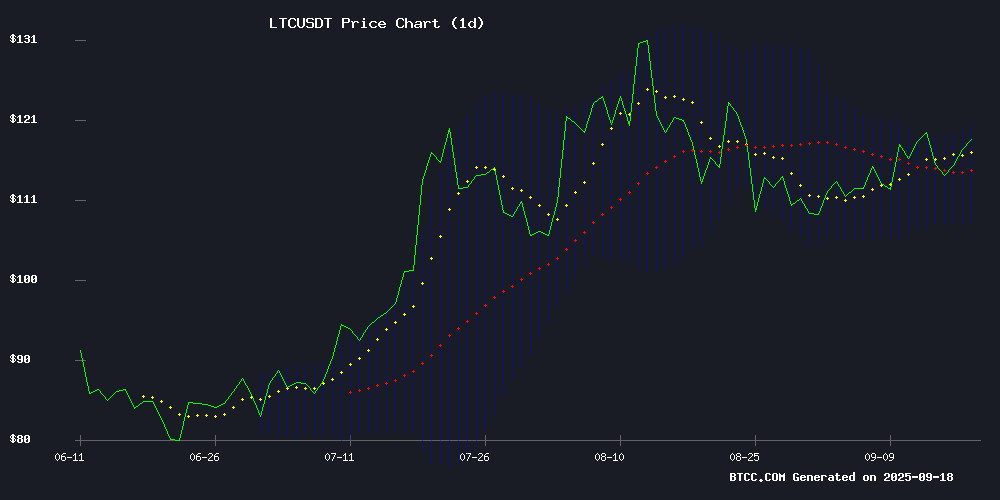

Litecoin is currently trading at $117.10, showing strength above its 20-day moving average of $113.83. According to BTCC financial analyst William, the MACD indicator remains negative at -2.53 but shows potential for momentum shift as the histogram reading of -1.96 suggests decreasing bearish pressure. The price is trading NEAR the upper Bollinger Band at $119.72, indicating potential resistance ahead. William notes that a sustained break above $120 could trigger further upside toward the $130-141 range.

Market Sentiment Turns Positive for Litecoin

Recent developments are creating favorable conditions for LTC. BTCC financial analyst William highlights that Litecoin's growing adoption in Australian payroll systems, combined with the Federal Reserve's interest rate cut, provides fundamental support. The expansion of cryptocurrency ETFs beyond Bitcoin and Ethereum also positions Litecoin favorably. William emphasizes that technical consolidation near current levels, coupled with positive news flow, suggests LTC is well-positioned for potential breakout moves.

Factors Influencing LTC's Price

Litecoin Gains Traction in Australian Payroll Systems Amid Crypto Adoption Surge

Australian businesses are increasingly adopting Litecoin (LTC) for payroll, drawn by its fast transaction speeds and low fees. The cryptocurrency's 2.5-minute confirmation time and cost efficiency make it a practical alternative to traditional payment methods.

Crypto payroll usage in Australia has more than tripled since 2023, reaching nearly 10% adoption by mid-2024. While stablecoins dominate, Litecoin's established network effects and technical advantages position it as a growing contender for wage disbursements.

Regulatory clarity from the Australian Treasury has created fertile ground for digital asset adoption. The workforce's familiarity with cryptocurrencies further accelerates this shift, with companies recognizing the operational benefits of blockchain-based payroll solutions.

Solana and Litecoin Face Growth Limits as Pepeto Emerges with 100x Potential

Market attention is shifting from established cryptocurrencies like Solana (SOL) and Litecoin (LTC) to emerging projects such as Pepeto (PEPETO), an Ethereum-based meme coin with functional utility. While SOL maintains support near its 20-day EMA, analysts suggest its days of 100x rallies may be over. Litecoin, once dubbed 'digital silver,' struggles against faster Layer 1 and Layer 2 solutions as liquidity thins.

Pepeto has raised over $6.6 million in presale at $0.000000153 per token, drawing comparisons to early-stage Ethereum. Its combination of meme virality, audited infrastructure, zero-fee trading, and yield mechanisms positions it as a potential 100x opportunity—a growth trajectory increasingly unlikely for mature large-cap assets.

Fed Cuts Interest Rates for First Time in 2025, Bitcoin and Altcoins Poised to React

The Federal Reserve delivered a widely anticipated 25-basis-point rate cut, marking its first easing move since 2025. The decision shifts the target range to 4.00%-4.25%, with policymakers leaving room for additional cuts amid growing concerns about employment and economic growth.

Market observers noted a distinct dovish tilt in the Fed's communications. One FOMC member reportedly dissented in favor of a more aggressive 50-basis-point reduction, believed to be Trump appointee Stephen Miran. The central bank's cautious approach maintains flexibility while acknowledging deteriorating macroeconomic conditions.

Cryptocurrency markets face potential volatility as the rate decision filters through risk assets. Bitcoin and altcoins typically benefit from looser monetary policy, with traders now scrutinizing forward guidance for clues about future easing trajectories. The Fed's pivot comes as digital assets show renewed sensitivity to traditional market dynamics.

LTC Breakout Looms: Can Litecoin Smash Resistance and Hit $141?

Litecoin (LTC) shows tentative signs of bullish momentum, trading at $114.10 with a 0.26% daily gain despite a 9.02% drop in volume to $532.45 million. The coin remains below critical resistance, awaiting confirmation for its next directional move.

Technical analysts identify $141.54 and $194.22 as key upside targets, following a rebound from Fibonacci support. The RSI at 49.25 and recent MACD crossover suggest neutral momentum, though breakout potential hinges on volume confirmation.

Market observers note Litecoin's stagnant weekly performance (-0.38%) lags behind broader crypto market trends. A decisive breach of current resistance could catalyze upward acceleration, while failure may prolong consolidation.

Cryptocurrency Market Rises Amid Strong ETF Inflows and Altcoin Momentum

The cryptocurrency market gained over 1% in the past 24 hours, with Bitcoin leading the charge as it rebounded from a low of $116,224 to surpass $117,000. Ethereum reclaimed the $4,500 level, while altcoins like XRP and ADA posted modest gains.

Bitwise Asset Management's filing for a stablecoin and tokenization ETF underscores growing institutional interest in real-world asset tokenization, reflecting broader market optimism.

Litecoin Eyes $130 Target Amid Consolidation, Analysts Bullish on Technical Setup

Litecoin's price action shows consolidation near $114 as traders await a decisive breakout. Market technicians highlight converging signals, with the MACD divergence and clustered analyst predictions suggesting upward momentum toward the $130-132 range within four weeks.

Resistance at $120.83 presents the immediate hurdle, while support holds firm at $106.38. Changelly's aggregated forecasts reveal striking consensus among analysts, with targets tightening between $127.26 and $131.63 over five sessions—a rare alignment indicating conviction in Litecoin's technical foundations.

The $130.19 median prediction reflects measured optimism, though traders note the 16% gap from current levels requires sustained buying pressure. Market structure suggests Litecoin is building energy for its next leg higher, but the path remains contingent on clearing key liquidity zones.

Crypto ETF Race Expands Beyond Bitcoin and Ethereum as Altcoins Enter Spotlight

The cryptocurrency ETF market is undergoing a significant transformation as investment firms shift focus beyond Bitcoin and Ethereum. A surge of new filings targets altcoins like Avalanche (AVAX), Litecoin (LTC), and even meme coin Bonk (BONK), signaling Wall Street's growing acceptance of alternative digital assets as legitimate investment vehicles.

Bitwise's spot Avalanche ETF filing leads the charge, offering indirect exposure to AVAX without direct token ownership. Defiance takes a different approach with Bitcoin and Ethereum "basis trade" ETFs, capitalizing on price differentials between spot and futures markets. Meanwhile, Tuttle's Income Blast brand prepares funds tied to Bonk, Litecoin, and Sui, while REX Shares seeks approval for a leveraged Orbs ETF using swaps and options.

Regulatory scrutiny remains intense, with analysts predicting the spot AVAX ETF as the most likely candidate for approval due to its straightforward structure. The move toward altcoin ETFs reflects institutional investors' demand for regulated products that capture broader crypto market opportunities.

Is LTC a good investment?

Based on current technical and fundamental analysis, LTC presents a compelling investment opportunity. The cryptocurrency is trading above key moving averages with bullish momentum indicators. Fundamental catalysts including institutional adoption and favorable macroeconomic conditions support further upside potential.

| Indicator | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | $117.10 vs $113.83 | Bullish |

| Bollinger Position | Near Upper Band | Neutral/Bullish |

| MACD Trend | Converging | Potential Reversal |

| Resistance Level | $119.72 | Key Breakout Point |